Choosing the right career path in finance and accounting can be daunting, especially when faced with the decision between pursuing the ICWA (Institute of Cost Accountants of India) or CA (Chartered Accountancy) qualification. Both courses offer promising career prospects and opportunities for professional growth, but each has unique features and requirements.

In this article, we'll delve into the intricacies of ICWA and CA and compare them in detail to help you make an informed decision about which course best aligns with your career goals and aspirations.

Bachelor of Accounting in Australia: Course Guide

ICWA: Institute of Cost Accountants of India

The Institute of Cost Accountants of India offers the ICWA course, recently rebranded as the CMA (Cost and Management Accountancy) course. This professional certification equips candidates with expertise in cost accounting, management accounting, financial management, and related areas. The ICWA qualification is recognized nationally and internationally, providing opportunities for employment in various sectors such as manufacturing, service, consultancy, and government.

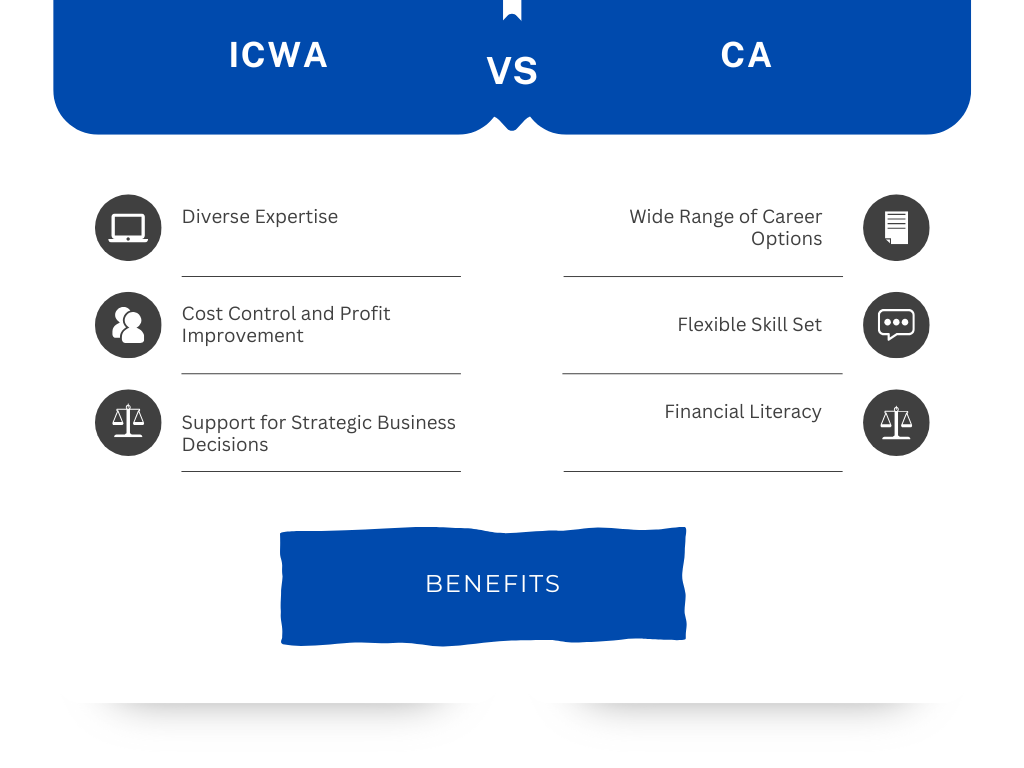

Benefits of Doing ICWA:

- Diverse Expertise: ICWA equips candidates with specialized knowledge in Budgeting, Cost Control, and Management Accounting, applicable across various industries and sectors.

- Strong Career Opportunities: ICWA holders are in high demand in industries such as production, manufacturing, logistics, finance, and services, offering a plethora of job prospects in both the public and private sectors.

- Cost Control and Profit Improvement: ICWAs are crucial in assisting businesses with cost analysis, resource optimization, and profitability enhancement, facilitating efficient cost-management and budgeting techniques.

- Support for Strategic Business Decisions: ICWAs provide vital financial information and analysis, aiding businesses in price setting, project evaluation, and expansion planning.

Curriculum and Syllabus:

The ICWA course curriculum comprises three levels: Foundation, Intermediate, and Final. Each level covers topics ranging from fundamentals of accounting and economics to advanced cost management techniques and strategic financial management. The comprehensive syllabus encompasses subjects like Financial Accounting, Cost and Management Accounting, Taxation, Auditing, Corporate Laws, and Ethics. Practical training and project work are integral components of the ICWA course, allowing candidates to gain hands-on experience and apply theoretical knowledge to real-world scenarios.

Career Opportunities:

Upon completion of the ICWA course, candidates can pursue various career paths. They may work as Cost Accountants, Management Accountants, Financial Analysts, Budget Analysts, Internal Auditors, or Tax Consultants in multiple organizations. The ICWA qualification is particularly valuable in industries where cost management and financial analysis are crucial for decision-making, such as manufacturing, construction, retail, and banking. Additionally, ICWA professionals have opportunities to advance their careers by obtaining specialized certifications or pursuing higher education in related fields.

|

CA: Chartered Accountancy

The CA course is offered by the Institute of Chartered Accountants of India (ICAI) and is one of the most prestigious professional qualifications in accounting and finance. Chartered Accountants are entrusted with responsibilities such as auditing financial statements, providing financial advice, taxation, and compliance services. The CA qualification is highly regarded globally, opening various career opportunities in diverse sectors.

Benefits of Doing CA:

- Wide Range of Career Options: CA qualification opens doors to diverse career paths in public practice, corporate finance, banking, government, and the nonprofit sector, providing ample opportunities for professional growth.

- High Demand: CAs are constantly sought after due to their expertise in financial management, taxation, and auditing, leading to competitive pay and job security.

- Flexible Skill Set: CA training imparts a versatile skill set encompassing financial analysis, auditing, tax planning, budgeting, and strategic financial management, enhancing career prospects and adaptability.

- Entrepreneurship: Many CAs opt to start their own accounting firms or consulting enterprises, leveraging their expertise to gain independence and establish their brands in the industry.

- Financial Literacy: CAs possess a thorough understanding of economic issues, enabling them to manage their accounts and investments effectively and fostering financial independence and stability.

Curriculum and Syllabus:

The CA course is structured into three levels: Foundation, Intermediate, and Final. The syllabus covers various subjects, including Accounting, Auditing, Taxation, Corporate Laws, Financial Management, and Information Technology. The rigorous curriculum is continuously updated to keep pace with industry trends and regulatory requirements. Practical training, known as Articleship, is an essential component of the CA course, enabling candidates to gain practical exposure and professional skills under the guidance of experienced Chartered Accountants.

Career Opportunities:

Chartered Accountants are in high demand across various industries, including public accounting firms, corporate organizations, government agencies, financial institutions, and consultancy firms. They can choose from many career paths, such as Auditors, Tax Consultants, Financial Advisors, Management Consultants, Investment Bankers, or even entrepreneurs. The CA qualification is highly versatile, allowing individuals to specialize in areas of their interest, such as taxation, forensic accounting, risk management, or advisory services. Moreover, Chartered Accountants often hold leadership positions and significantly shape organizational strategies and financial decision-making processes.

Bachelor of Accounting in USA: Top Universities & College

Comparison: ICWA Vs CA

Now that we have explored the key features of both ICWA and CA courses let's compare them based on various parameters to help you make an informed decision:

Scope and Specialization:

ICWA: Specializes in cost accounting, management accounting, and financial management.

CA: Offers a broader spectrum of subjects, including accounting, auditing, taxation, and corporate laws.

Recognition and Prestige:

ICWA: Recognized nationally and internationally, particularly valued in industries focusing on cost management.

CA: Highly prestigious qualification with global recognition, regarded as the pinnacle of excellence in accounting.

Career Opportunities:

ICWA: Offers diverse career opportunities in cost accounting, management accounting, and financial analysis.

CA: Provides various career paths in auditing, taxation, financial advisory, consultancy, and leadership roles.

Curriculum and Complexity:

ICWA: Emphasizes cost accounting techniques, strategic financial management, and decision-making tools.

CA: Covers a comprehensive range of subjects, including complex accounting standards, auditing procedures, and taxation laws.

Examination Structure:

ICWA: Three-tier examination system (Foundation, Intermediate, and Final) with practical training and project work.

CA: Three-level examination process (Foundation, Intermediate, and Final) with mandatory Articleship training and practical experience.