Pursuing higher education is a dream for many, but the financial burden can often seem daunting. However, this dream can become a reality with the proper guidance and assistance.

Bank of Baroda, one of India's leading public sector banks, offers a range of education loan schemes designed to ease the financial burden and help students achieve their academic aspirations. This article will delve into the intricacies of obtaining a Bank of Baroda education loan, equipping you with all the necessary information to navigate the process seamlessly.

Check Out More: Things to Know Before Applying for a Study Abroad Education Loan for Your Child

Understanding Bank of Baroda's Education Loan Portfolio

Established in 1908, the Bank of Baroda has been a trusted financial institution, catering to the diverse needs of corporate and retail customers across the country and beyond. With a deep understanding of the importance of education, the Bank has curated a range of education loan schemes tailored to meet the unique requirements of students pursuing various levels of education.

Benefits of Choosing Bank of Baroda for Your Education Loan

When you choose Bank of Baroda for your education loan, you can expect a host of benefits that make the process convenient and cost-effective:

Competitive Interest Rates: Bank of Baroda offers highly competitive interest rates across its education loan schemes, ensuring you can finance your education without breaking the Bank.

Flexible Repayment Options: The Bank understands that every student's financial situation is unique, so it provides flexible repayment options, including extended loan tenures of up to 15 years.

Minimal Documentation: Bank of Baroda has streamlined the documentation process, reducing the paperwork burden and making the application process smoother.

Speedy Disbursal: Once your loan is approved, the Bank ensures swift disbursal of funds, allowing you to focus on your educational pursuits without unnecessary delays.

Zero Processing Fees: In most cases, the Bank of Baroda does not charge processing fees, further reducing the overall cost of your education loan.

No Early Closure Charges: If you wish to close your loan early, Bank of Baroda does not impose any additional charges, giving you the flexibility to manage your finances effectively.

Also Read: Things to Know Before Applying for a Study Abroad

Eligibility Criteria for Bank of Baroda Education Loans

To be eligible for a Bank of Baroda education loan, you must meet the following criteria:

- Nationality: You must be an Indian citizen to apply for an education loan from the Bank of Baroda.

- Admission Confirmation: You must have secured admission to a recognized educational institution in India or abroad for the course you wish to pursue.

- Course Eligibility: Bank of Baroda offers education loans for various courses, including graduation, post-graduation, professional courses (such as CA, CFA, CIMA), management courses, computer certificate courses, diploma programs, and teacher training courses.

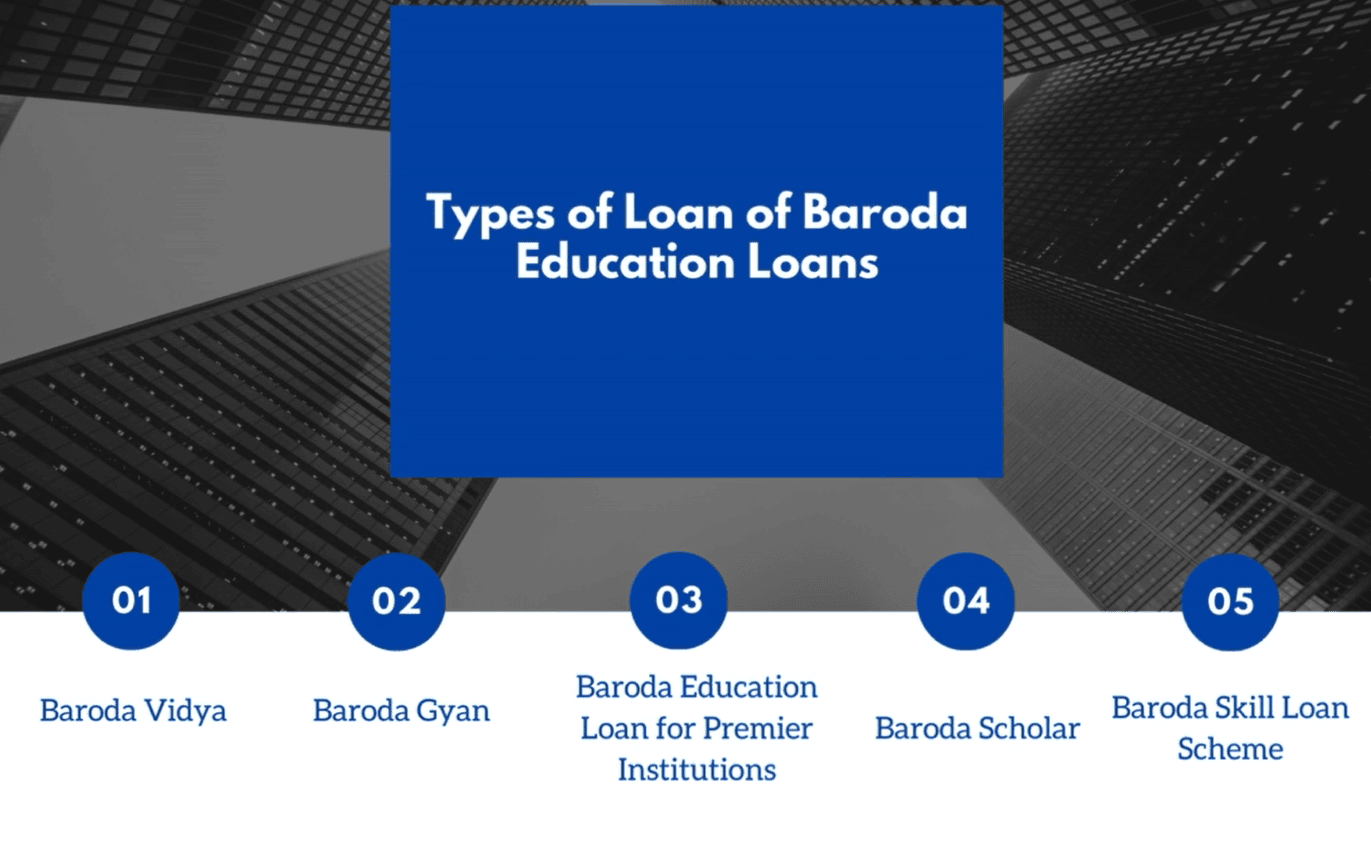

Types of Loan of Baroda Education Loans

Bank of Baroda has designed a diverse range of education loan schemes to cater to students' varying needs. Let's explore some of the popular schemes:

Baroda Vidya

Baroda Vidya is a specialised loan scheme designed for students pursuing school education. One of the key advantages of this scheme is that it does not require any collateral for loans up to Rs. 4 lakh, making it an attractive option for families with limited financial resources.

Baroda Gyan

Baroda Gyan is a comprehensive loan scheme that covers a wide range of courses, including graduation, post-graduation, professional courses, management programs, computer certificate courses, and diploma courses. While no collateral is required for loans up to Rs. 4 lakh, collateral becomes mandatory for loan amounts exceeding this limit.

Baroda Education Loan for Premier Institutions (For Studies in India)

This scheme is tailored specifically for students who have secured admission to premier educational institutions in India. It offers desirable interest rates, ranging from 8.15% to 9.95% per annum, making it an excellent choice for those seeking quality education at prestigious institutions within the country.

Students Also Checked: Study in India

Baroda Scholar

Baroda Scholar is designed for students pursuing higher education abroad. This scheme provides loans up to Rs. 150 lakh, with flexible repayment options and competitive interest rates ranging from 9.70% to 11.70% per annum. Additionally, female applicants can avail of a 0.50% concession on the interest rate.

Baroda Skill Loan Scheme

The Bank of Baroda offers the Baroda Skill Loan Scheme to recognize the importance of skill development and vocational training. This scheme provides loans up to Rs. 1.5 lakh, with attractive interest rates and flexible repayment options, empowering individuals to enhance their skills and employability.

Interest Rates and Loan Amounts

One of the most crucial factors to consider when applying for an education loan is the interest rate and the maximum loan amount available. Bank of Baroda offers competitive interest rates across its various education loan schemes, ensuring students can finance their education without excessive costs.

Here's a table summarising the interest rates and maximum loan amounts for some of the popular Bank of Baroda education loan schemes as of 2024:

|

Scheme |

Interest Rates |

Maximum Loan Amount |

|

Baroda Vidya |

12.50% p.a. |

Based on course and institution |

|

Baroda Gyan |

11.05% to 13.05% p.a. |

Based on course and institution |

|

Baroda Education Loan for Premier Institutions (For Studies in India) |

8.15% to 9.95% p.a. |

Rs. 125 lakh |

|

Baroda Scholar |

9.70% to 11.70% p.a. |

Rs. 150 lakh |

|

Baroda Skill Loan Scheme |

10.65% p.a. |

Rs. 1.5 lakh |

Please note that interest rates and loan amounts are subject to change, and it's advisable to check the bank's website or contact customer service for the latest information.

You Might Also Like: How to Save Money With the Right Education Loan?

Documentation Required for Bank of Baroda Education Loan

To apply for a Bank of Baroda education loan, you must submit a comprehensive set of documents. While the specific requirements may vary based on the loan scheme and your circumstances, here's a general list of documents you'll need to have ready:

Application Form: You'll need to complete the education loan application form provided by the Bank of Baroda.

Passport-size Photographs: Recent passport-size photographs of the applicant and co-borrower (if applicable) are required.

Proof of Admission: You must provide proof of admission to the educational institution, such as an admission letter or enrollment confirmation.

Income Proof: If you have a co-borrower or guarantor, you must provide their income proof, such as salary slips, Form 16, bank statements, or income tax returns (for self-employed individuals).

|

Collateral Documents: Depending on the loan amount and scheme, you may be required to provide collateral documents, such as property papers or third-party guarantees.

Bank Statements: Recent bank statements (typically for the last six months) may be required to assess your financial standing.

Academic Documents: You must submit academic documents, such as 10th and 12th mark sheets, entrance exam scores, and other relevant academic records.

Address Proof: Acceptable address proof documents include Voter's ID, Driving License, Aadhaar Card, or Passport.

Identity Proof: Acceptable identity proof documents include PAN Card, Aadhaar Card, Passport, Voter's ID, or Driving License.

It's important to note that the Bank may request additional documents based on your specific circumstances. Therefore, checking with the Bank beforehand is advisable to ensure a smooth and hassle-free application process.

Study Abroad With Studyinfocentre

FAQs

What are the main benefits of taking an education loan from the Bank of Baroda?

Some key benefits include competitive interest rates, flexible repayment options, minimal documentation, speedy disbursal of funds, no processing fees, and no early closure charges.

What are the eligibility criteria for a Bank of Baroda education loan?

To be eligible, you must be an Indian citizen, have secured admission to a recognized educational institution, and the course you wish to pursue must be covered under the Bank's education loan schemes.

What are some of the famous Bank of Baroda education loan schemes?

Some popular schemes include Baroda Vidya (for school education), Baroda Gyan (for graduation, post-graduation, and professional courses), Baroda Education Loan for Premier Institutions (for studies in premier Indian institutions), Baroda Scholar (for studies abroad), and Baroda Skill Loan Scheme (for skill development and vocational training).

What is the Baroda Scholar scheme's maximum loan amount and interest rate?

The Baroda Scholar scheme provides loans up to Rs. 150 lakh, with interest rates ranging from 9.70% to 11.70% per annum. Female applicants can avail of a 0.50% concession on the interest rate.

What documents are typically required for a Bank of Baroda education loan application?

Standard documents required include the application form, passport-size photographs, proof of admission, income proof (for co-borrower or guarantor), collateral documents (if applicable), bank statements, academic documents, address proof, and identity proof.