Education is a cornerstone of personal and professional growth, yet the rising tuition and living expenses often present a significant barrier. To bridge this gap, financial institutions like ICICI Bank offer education loans tailored to meet the diverse needs of students. Understanding the disbursement process of an education loan is crucial for applicants seeking financial assistance.

In this guide, we delve into the intricate details of the ICICI Bank education loan disbursement process to provide clarity and insight for prospective borrowers.

ICFAI Business School: What's Popular?

Overview of ICICI Bank Education Loans

ICICI Bank, one of India's leading private sector banks, offers a range of financial products and services, including education loans. These loans are designed to support students pursuing higher education in India and abroad financially. The bank extends loans for various courses, including undergraduate, postgraduate, and professional programs.

|

Key Features of ICICI Bank Education Loans

- Loan Amount: ICICI Bank offers education loans ranging from a few lakhs to INR 1 crore, depending on the course and the institution's credibility.

- Flexible Repayment Options: Borrowers can choose from various repayment plans, including moratorium periods up to six months post-course completion.

- Competitive Interest Rates: ICICI Bank offers competitive interest rates on education loans, making it an attractive option for students.

- Quick Processing: The bank aims to process loan applications, ensuring timely disbursal of funds swiftly.

- Collateral Requirements: Depending on the loan amount, collateral may be required. However, collateral may be waived off for smaller loan amounts under certain conditions.

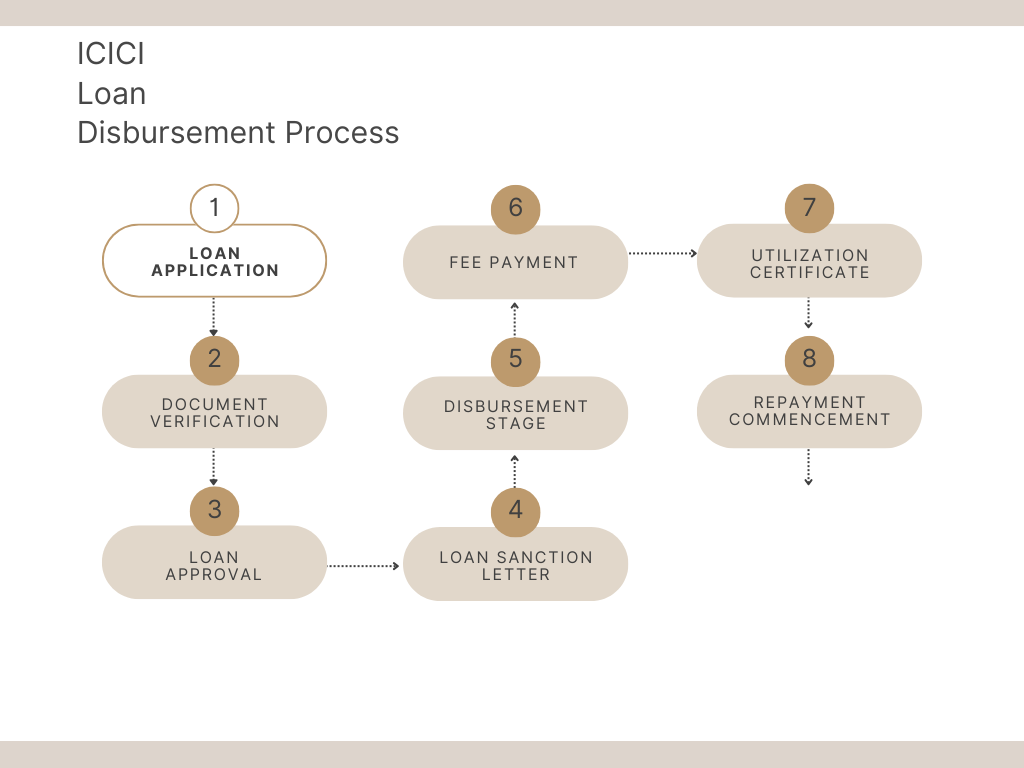

ICICI Loan Disbursement Process

The disbursement process of an ICICI Bank education loan involves several stages, each requiring specific documentation and verification. Let's explore each step in detail:

Loan Application:

The first step is to submit a comprehensive loan application form and the necessary documents. These documents typically include proof of identity, address, course admission letter, academic records, and income proof of the co-applicant (if applicable).

Document Verification:

Once the application is submitted, ICICI Bank thoroughly verifies the provided documents to ensure accuracy and authenticity. Any discrepancies or additional information required may lead to further communication with the applicant.

Loan Approval:

Upon successful verification, the loan application is forwarded for approval. ICICI Bank assesses various factors, such as the applicant's creditworthiness, course credibility, and collateral (if applicable) before approving the loan.

Loan Sanction Letter:

Upon approval, the bank issues a loan sanction letter outlining the approved loan amount, repayment terms, interest rate, and other relevant details. The borrower must review the sanction letter carefully and accept the terms to proceed with the disbursement process.

Disbursement Stage:

The disbursement process commences once the borrower accepts the terms outlined in the sanction letter. The disbursement is typically done in stages or as a lump sum, depending on the course's duration and fee structure.

Fee Payment:

In the case of direct fee payment to the institution, ICICI Bank transfers the approved loan amount directly to the educational institution's account as per the fee schedule provided by the borrower. This ensures seamless payment of tuition fees and other related expenses.

Utilization Certificate:

After the disbursement, the educational institution must provide a utilization certificate confirming the utilization of the funds for the intended purpose. This certificate serves as proof of fund utilization and is an essential document for loan repayment.

Repayment Commencement:

Repayment of the education loan typically begins after the completion of the course or the moratorium period, whichever is earlier. ICICI Bank offers various repayment options, including flexible EMI plans, to ease the financial burden on borrowers.

ICICI Bank provides education loans for studying abroad, with distinct eligibility criteria to consider. Here's a breakdown of the eligibility requirements for obtaining an abroad education loan from ICICI Bank.

ICAR AIEEA 2023 Preparation & Study Plan for 30 Days

ICICI Bank: Education Loan Eligibility

Primary Eligibility:

- Citizenship: Applicants must hold Indian citizenship.

- Age: Applicants should fall within the age bracket of 18 to 35 years at the time of loan application.

- Academic Admission: Securing admission to a recognized foreign university for a higher education program is imperative, typically achieved through entrance examinations.

- Co-applicant: A co-applicant (parent, guardian, or sibling) with a stable income is obligatory for loan approval.

Additional Eligibility Criteria:

- Course and University Accreditation: The selected course and university must hold accreditation from the University Grants Commission (UGC) or other relevant regulatory bodies.

- Loan Amount: While the maximum loan amount for overseas education is Rs. 2 crore, the sanctioned sum depends on factors such as the applicant's academic history, course fees, co-applicants income, and the destination country.

- Margin Requirement: A margin of 10-25% of the total course fees is typically necessary for abroad education loans. This means applicants need to arrange this percentage of fees from personal resources. However, there are exceptions with no margin requirement for select programs offered by premium institutes.

- Credit Score: Both the applicant and co-applicant must maintain a favorable credit score to qualify for the loan.