In a world increasingly reliant on specialized skills, vocational education stands out as a pathway to success for many individuals. Recognizing the importance of vocational training, the IBA (International Bank of Agriculture) has introduced a groundbreaking loan scheme explicitly tailored for aspiring individuals seeking vocational education.

Vocational education plays a crucial role in addressing the ever-evolving demands of industries across various sectors. Unlike traditional academic programs, vocational education focuses on providing practical skills and knowledge directly applicable to specific professions. In today's dynamic job market, where specialized skills are highly sought, vocational education offers a viable alternative for individuals seeking rewarding careers.

This article delves into the details of this initiative, exploring its significance, eligibility criteria, application process, and the potential impact it could have on individuals and economies alike.

A-Z Guide to Student Loans for Studying Abroad

The Role of IBA in Empowering Aspirants

The International Bank of Agriculture (IBA) has long been committed to fostering economic development and empowering individuals through financial assistance programs. With the introduction of the IBA Grants Loan Scheme for Vocational Education, the bank aims to further its mission by providing aspiring individuals with the means to pursue vocational training and enhance their employability.

|

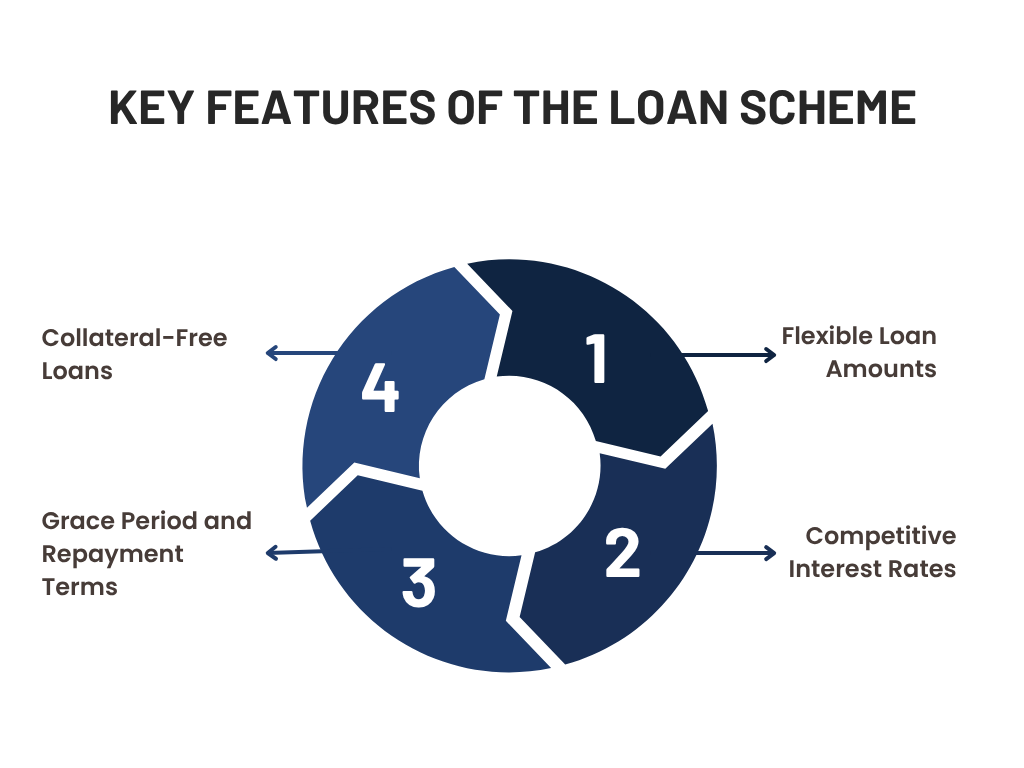

Key Features of the Loan Scheme

The IBA Grants Loan Scheme for Vocational Education offers several key features designed to facilitate access to quality training programs:

- Flexible Loan Amounts: Applicants can avail themselves of loans tailored to their specific educational requirements, covering tuition fees, course materials, and other related expenses.

- Competitive Interest Rates: The loan scheme offers competitive interest rates, ensuring affordability for borrowers and minimizing financial burdens.

- Grace Period and Repayment Terms: Borrowers are given a grace period before repayment commences, allowing them to focus on completing their education without immediate financial pressure. Repayment terms are structured to accommodate the individual's financial situation post-graduation.

- Collateral-Free Loans: Unlike traditional loans that often require collateral, the IBA Grants Loan Scheme for Vocational Education offers collateral-free financing, making it accessible to a broader pool of applicants.

Eligibility Criteria

To qualify for the IBA Grants Loan Scheme for Vocational Education, applicants must meet the following eligibility criteria:

- Demonstrated Financial Need: Applicants must demonstrate financial need and the inability to fund their vocational education independently.

- Acceptance into Accredited Programs: Applicants must provide proof of acceptance into accredited vocational training programs recognized by the relevant authorities.

- Good Academic Standing: While academic performance may not be the primary criterion, applicants are generally expected to maintain a satisfactory academic record.

- Residency and Citizenship Requirements: Depending on the jurisdiction, applicants may need to meet residency and citizenship requirements specified by the IBA.

Application Process

The application process for the IBA Grants Loan Scheme for Vocational Education is straightforward and typically involves the following steps:

- Submission of Application: Prospective borrowers must submit a completed application form and supporting documents, including financial statements and proof of acceptance into a vocational training program.

- Assessment and Approval: The IBA evaluates each application based on the eligibility criteria and financial viability. Upon approval, borrowers are notified of the loan terms and conditions.

- Disbursement of Funds: Once the loan is approved, the funds are disbursed directly to the educational institution to cover tuition fees and other approved expenses.

- Loan Management and Repayment: Borrowers are provided with guidance on managing their loans and are expected to adhere to the repayment terms outlined in the loan agreement.

How to Get Educational Loans for Working Professionals

Potential Impact and Benefits

The IBA Grants Loan Scheme for Vocational Education holds immense potential to transform the lives of individuals and contribute to economic growth in several ways:

- Enhanced Employability: By enabling individuals to acquire specialized skills and certifications, the loan scheme enhances their employability and opens various career opportunities.

- Addressing Skills Gap: Vocational education is crucial in addressing the skills gap in many industries. By supporting vocational training initiatives, the IBA helps bridge this gap and ensures a skilled workforce capable of meeting industry demands.

- Empowering Underserved Communities: The loan scheme extends financial support to individuals from underserved communities who may otherwise lack access to quality education and training opportunities.

- Stimulating Economic Growth: Investing in vocational education benefits individuals and promotes economic growth by fostering innovation, entrepreneurship, and productivity across various sectors.